Internal Rate of Return (IRR)

Real Estate Definitions for Real Estate Investing

View a tutorial on Internal Rate of Return (IRR)

Internal Rate of Return (IRR)

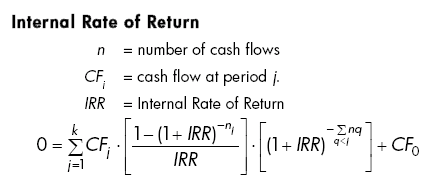

When you have an investment that creates differing amounts of annual cash flow, you need to determine your rate of return using the Internal Rate of Return (IRR). The formula for computing the IRR is very complicated but essentially IRR is the rate needed to convert (or discount or reduce) the sum of the future uneven cash flow to equal your initial investment or down payment.

A very simple example is say that you invest $50.

The investment has cash flow of $5 in year 1, and $20 in year 2. At the end of year 2, the investment is liquidated and the $50 is returned.

The total profit is $25 ($5 Y1 and $20 Y2).

Simple division would say that the return is 50% ($25/50). But since time value of money (two years in this example) impacts return, the IRR is actually only 23.43%.

If we had received the $25 cash flow and $50 investment returned all in Year 1, then yes, the IRR would be 50%. But because we had to “spread” the cash flow over two years, the return percentage is negatively impacted.

The timing of when cash flow is received has a significant and direct impact on the calculated return. In other words, the sooner you receive the cash, the higher the IRR will be.

Let’s take the above example, but reverse the cash flow.

$20 Y1 and $5 Y2.

We still received $25 in profit, but because we received more of the cash flow sooner, the IRR goes from 23.43 to 26.77%.

Another way to look at it is the internal rate of return (IRR) is the discount rate at which the “net” present value of future cash flows is zero (discounted future cash flows = starting investment amount). The “net” meaning you subtract your initial investment.

Leveraged vs. Unleveraged Internal Rate of Return (IRR)

When you use debt to purchase a property, then you are using leverage. The Cash Flow Analyzer® software computes your IRR based on how debt impacts your cash flow. The software automatically backs out interest and debt payments and calculates an Unleveraged IRR assuming 100% down payment.

You can compare the leveraged and unleveraged IRR’s to determine how debt is helping or hindering investment results.

Our real estate investment software calculates an Internal Rate of Return (IRR) so that you are in a better position of understating how much to offer for a particular property and make the appropriate presentations to bankers, lenders and prospective real estate partners.